Hello,

The first quarter of the year has been marked by heightened uncertainty, a theme we expect to continue shaping the market. That said, we believe that economic and market dislocations will keep creating disruptions, ultimately presenting attractive opportunities for well-capitalized, strategic investors.

The notable decline in multifamily permitting over the past two years is now beginning to impact

new deliveries, with completions tapering off across many markets, particularly in the Sunbelt.

However, we believe uncertainty will weigh on new construction activity even more than current

interest rates or market dynamics alone. As a result, we anticipate that the multifamily supply

shortage will be deeper and more prolonged than many expect.

At the same time, apartment demand has remained strong, reaching levels only surpassed during the post-COVID surge. This has helped occupancy rates shift direction in several Sunbelt markets. Even in the event of a potential economic slowdown this year, we believe demand is unlikely to decline significantly, as Millennials remain priced out of homeownership and older members of Gen Z enter their prime rental years.

While overall sentiment is down, we believe the fundamentals are telling a very different story. This disconnect between perception and reality is creating a window for long-term investors to gain exposure while others remain on the sidelines. In our view, this is a moment that favors patient, well-capitalized investors who are able to look past the noise and stay focused on long-term value.

All my best,

Gerardo Gutierrez

CEO DDelta REI

“The Sunbelt is picking up steam. While construction activity across the southern U.S. has been falling in aggregate since early 2023, with less than 5% of the market’s inventory currently under construction—the second lowest among all regions—demand continues to outpace supply. If this strong demand persists, rent growth, which has been ticking up consistently since 2024 (now at 1.6% YOY, double the 0.8% recorded in Q1 2024), will continue to build momentum heading into the second half of the year”

– Cushman & Wakefield.

Quarterly Highlights

- Three out of our Fund VI investments, Lookout, Junewood and The Everett completed their first full quarter of operations, progressing through the early lease-up phase.

- Construction was completed on both Junewood and Lookout during Q1, and all units have been delivered to the operations team.

- The Everett remains under construction, currently 97% complete, and is on track for full delivery in the coming months.

- We formally launched the disposition process for two assets:

- Heritage Plaza, a deal-by-deal investment and the only asset currently held outside our funds.

- Veranda, the first Fund V asset brought to market.

Insights – Target Markets Supply/Demand Dynamics

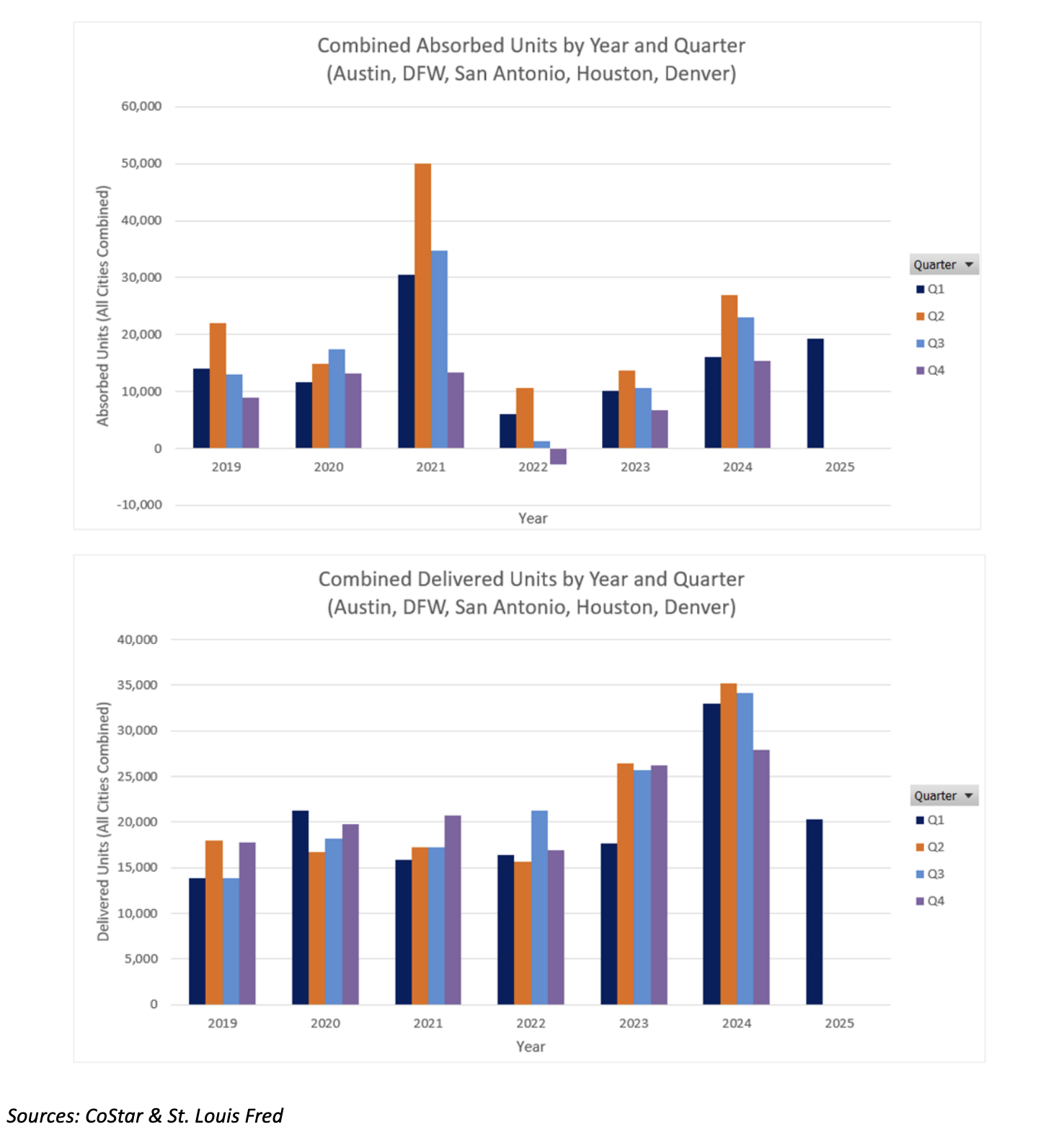

- Across our target markets—Austin, San Antonio, Houston, Dallas-Fort Worth, and Denver— we are seeing a meaningful shift in multifamily dynamics, with demand strengthening while new supply slows.

- Net absorption across our target markets surged in Q1, exceeding the 10-year average for first quarters by 36%, driven by sustained renter demand and demographic tailwinds.

- Deliveries dropped nearly 40% year-over-year, a direct result of the steep decline in permitting and new starts observed over the past two years.

Local Market Insights:

Austin

Austin was among the hardest-hit markets nationwide over the past two years, as a wave of new deliveries flooded the markets. This imbalance placed pressure on asset performance, slowing leasing velocity, reducing occupancy, and stalling rent growth across the metro. However, Q1 2025 marked a potential inflection point: for the first time in three years, net absorption exceeded new deliveries. Additionally, new construction volume is down 64% from its 2024 peak, a trend expected to continue through 2025 and 2026. Population growth remains one of the market’s strongest tailwinds, increasing by 1.9% year-over-year in 2024—nearly double the national average— underscoring Austin’s long-term demand potential.

San Antonio

San Antonio continues to face a supply imbalance. Although demand remains healthy—Q1 absorption was 65% above the pre-COVID 5-year Q1 average—it still lags the elevated pace of new deliveries. As in other Texas markets, construction starts are expected to slow, which should help relieve pressure as we move through the year. The metro’s population grew by 1.2% in 2024, reflecting steady in-migration and supporting its long-term renter base.

Denver

Despite ongoing oversupply, the imbalance is easing. The supply-demand gap has narrowed by 86% from its Q4 2023 peak, a positive sign for market stabilization. Deliveries are down nearly 50% from 2024 highs, and further slowdowns are anticipated, creating a more favorable setup for absorption in the medium term. Although population growth has slowed from post-COVID surges, it remains on par with national trends.

Houston

Houston experienced a significant influx of new deliveries over the past two years, yet strong underlying demand allowed the market to maintain positive annual rent growth—a notable outlier among Texas metros. Fundamentals are gradually improving. Deliveries are currently 21% below the pre-COVID 5-year Q1 average, suggesting a potential tightening in the future, but continued absorption will be key. The city posted 1.5% population growth in 2024, the second highest among Texas’ major metros, positioning it for continued demand resilience.

DFW

DFW was heavily hit in terms of new supply in 2024. Even so, demand remained 40% above pre- pandemic Q1 averages. Looking ahead, absorption is expected to normalize, and new deliveries are projected to decline, potentially restoring better balance by year-end. Population grew by 1.3% in 2024, reinforcing its position as one of Texas’ high growth markets.

What this means for investors:

As new construction slows and renter demand remains resilient, we believe the current market dislocation is setting the stage for a stronger-than-expected recovery in rent growth and occupancy. This dynamic favors sponsors who can strategically time acquisitions or developments ahead of a broader recovery.

Not an offer: This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are

encouraged to contact Gerardo Gutierrez – CEO – or consult with the professional advisor of their choosing.

Past Performance: There is no guarantee that the investment objectives will be achieved. Moreover, the past performance is not a guarantee or indicator of future results.

Forward-looking statements: Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Currentness: Except where otherwise indicated, the information contained in this presentation is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decision.

Confidentiality: This presentation is confidential, is intended only for the person to whom it has been directly provided and under no circumstances may a copy be shown, copied, transmitted or otherwise be given to any person other than the authorized recipient without the prior written consent of Gerardo Gutierrez – CEO.

An investment in the Fund involves risks, including loss of the entire investment. For further risk considerations, see more here.