Hello,

The second quarter of 2025 marks another period of recovery after vacancy rates seemed to peak during the first months of the year. Apartment demand has been significantly strong, especially for Class A assets, reaching record absorption rates only exceeded by post-pandemic trends. At the same time, a significant number of units that were under construction in high-growth markets have already been delivered during the first half of this year. While it will take some time to absorb these units, deliveries have peaked, and a more balanced market is on the horizon as supply continues to wind down while demand fundamentals remain strong.

We are periodically monitoring our markets as we remain committed to making opportunistic investments based on market conditions. We will continue to focus our efforts on acquiring assets below replacement cost, where strong value is driven by local barriers to entry, favorable supply-demand dynamics, and operational inefficiencies – in markets that we know well. While we recognize potential for new development in an environment of constrained supply, high construction costs and financing challenges continue to make ground-up opportunities difficult.

Our outlook remains positive as the building blocks for recovery are coming into place and the deal-making pause is already behind us.

All my best,

Gerardo Gutierrez

CEO DDelta REI

Quarterly Highlights

- Completed the sale of Heritage Plaza, a core asset located in the heart of San Antonio, TX.

- Signed a Memorandum of Understanding with the Austin Affordable Housing Corporation to convert The Everett to an HFC structure – expanding affordability while unlocking potential tax benefits.

- Continued to find operational efficiencies in our portfolio, generating ~30% savings on insurance costs for properties in our Fund V & Fund VI.

- Executed a ground lease for an existing pad in North San Antonio (1.67 acres).

- Signed a PSA to sell 2.2 acres in Cedar Park (Austin, TX).

Insights – Target Markets Supply/Demand Dynamics

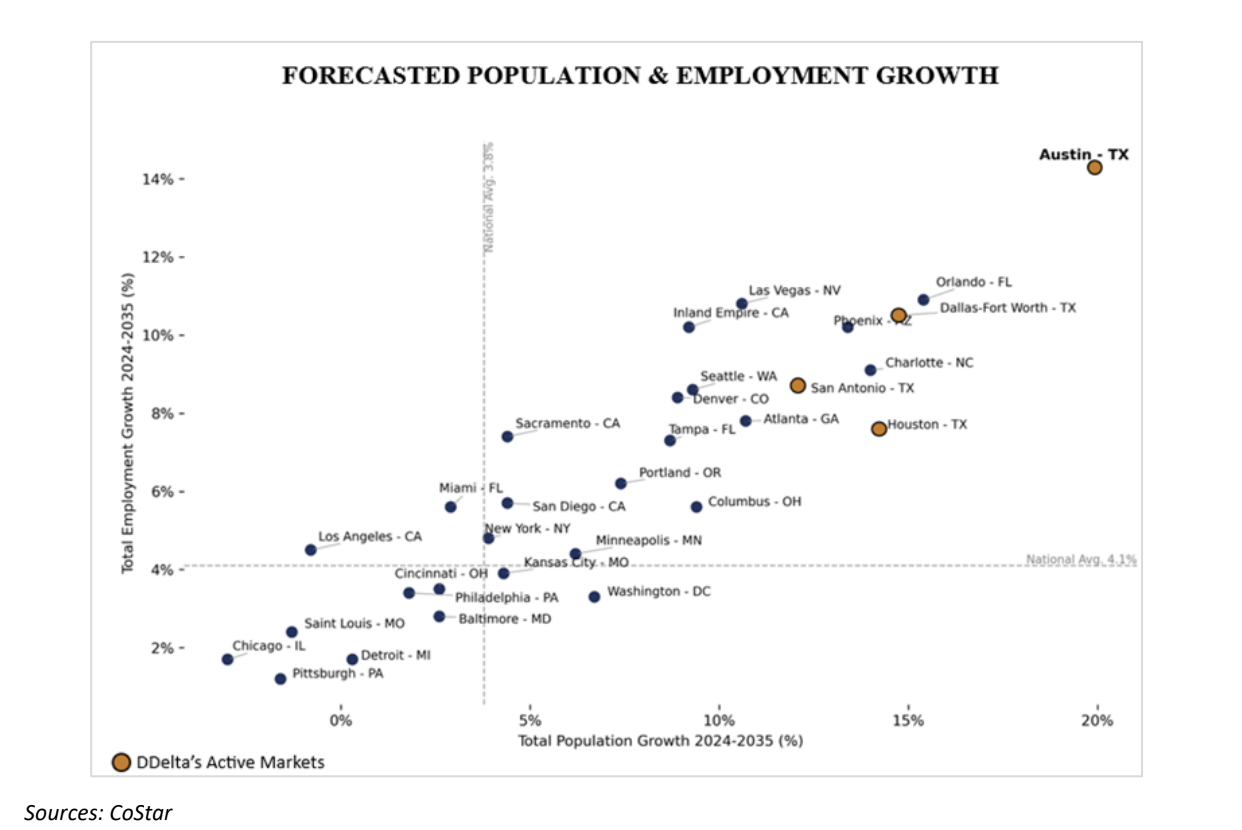

- Since we opened our doors, we have been investing in the main 4 Texas markets: Austin, Houston, DFW and San Antonio. Even though we continue to explore other locations around the Sunbelt that exhibit similar growth patterns, we expect to continue to deploy a significant number of resources in Texas given how strong the fundamentals continue to be.

- Despite current temporary headwinds, we remain bullish on our active markets. Projected economic and population growth is expected to remain very strong during the next 10 years, outpacing most other major cities across the U.S., according to CoStar. This, along with a significant and persistent affordability gap, is expected to continue to drive inherent demand for high-quality rental housing in the long term.

- The opportunity is clear for operators who have boots on the ground and local expertise, as they could identify pockets of opportunity driven by local demand/supply dynamics while benefiting from broader macroeconomic trends.

Not an offer: This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact Gerardo Gutierrez – CEO – or consult with the professional advisor of their choosing.

Past Performance: There is no guarantee that the investment objectives will be achieved. Moreover, the past performance is not a guarantee or indicator of future results.

Forward-looking statements: Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Currentness: Except where otherwise indicated, the information contained in this presentation is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decision.

Confidentiality: This presentation is confidential, is intended only for the person to whom it has been directly provided and under no circumstances may a copy be shown, copied, transmitted or otherwise be given to any person other than the authorized recipient without the prior written consent of Gerardo Gutierrez – CEO.

An investment in the Fund involves risks, including loss of the entire investment. For further risk considerations, see more here.