Hello,

It is our pleasure to reconnect with you as we start a new quarter at DDelta REI. Our company has made significant progress towards our goals as we raise capital for our new Multifamily Acquisitions and Development Fund VII. As we head into 2024, cap rates are continuing to adjust upwards, setting the stage for improved buying opportunities for well capitalized owners in the next two years.

Thanks for your continued support.

All my best,

Gerardo Gutierrez

CEO DDelta REI

“Since inception, DDelta REI has been able to invest over $390M of equity, which translates to over $1.4B in total project costs”.

Quarterly Highlights

- Are there opportunities in Texas Multifamily? Watch the recording here. Passcode: T3xasMF!

- Rental rates on properties delivering new units continue to exceed our initial expectations by an average of ~13%.

- 368 units were delivered across two of our high growth target markets: Houston and Austin, TX.

Company Update

- DDelta REI launches its fundraising for Fund VII with a target equity raise of $150M. The Fund will target equity investments in approximately +$375M of multifamily developments in Sun Belt markets, and multifamily acquisitions with greater geographical exposure, over the next 12-18 months.

- We are continuously monitoring a +$1B pipeline, which will allow us to carefully select the best possible off-market deals.

- We are attending the New York City Comptroller’s Annual Diverse & Emerging Managers Investment Conference on November 16th. If you, or some of your colleagues, are planning to attend, we would like to meet you there!

Insight

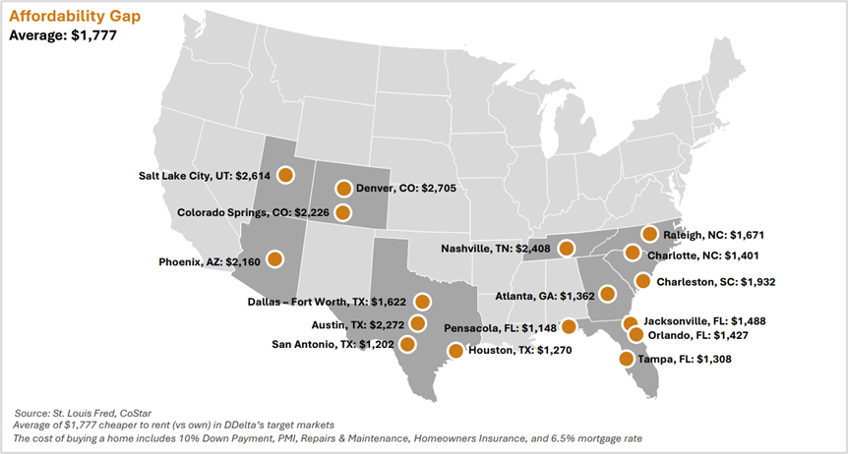

- The average affordability gap in DDelta’s target markets has increased by about 31% year over year, reaching ~$1,777 as of Q3-2023. As we head into 2024, continued elevated home prices and high mortgage rates will continue to support demand for multifamily units.